Sharing is caring!

You will get to know more about Provident Fund(including EPF, VPF, and PPF) and how it helps in retirement planning in Chapter 6 of this series. Currently, let us see the EPF calculation to understand how far EPF alone makes you stand in your Retirement Planning Journey.

EPF interest rate is 8.1% as of today i.e, FY2022. It is a 40-year low. For the Calculation purpose let us use the same interest rate i.e, 8.1%. In the future, the interest rate for the EPF may increase or decrease, Even if the interest rate increases planning and preparing with a bit low percentage of return is always good because you won’t face any shortage of funds when you need if the rate of return fall during your investment period. Do you remember I discussed the same in the post(Personal Finance Rules for Investment)t? Please do consider reading those rules because you will learn not about the rules but the application of those rules for your financial planning in future blog posts on this site.

Table of Contents

ToggleRising Income Levels In India

Forget about the past, but luckily the employment opportunities are raising in India since this decade is so special that more and more startups are getting started and a few of them also joining the Unicorn Startup Club, this is out of the scope of this blog post, but if you want to learn more about these macro-economic changes in India do follow our Macro Economy Category. The conclusion is, that more and more startups are equal to more and more employment opportunities. Also, most companies discuss in their annual reports that India will see rising income levels for people, and there is a shift that in a family both husband and wife are willing to work. The Indian Government also trying to implement Labour Codes, out of which one code is about social security, that increase your PF Contribution during your employment so you will build a greater retirement corpus through EPF.

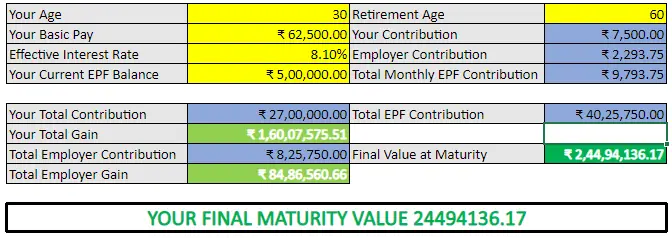

To go forward with the EPF Calculation, as per the discussion above considering your annual salary of about 15 LPA fixed, which would have nearly 7000/- per month dedication towards EPF. And there is an additional contribution from your employer totaling 15.67%, so the monthly PF Contribution would come to around: 9793(Employee: 7500, Employer: 2293).

EPF Calculation

Generally one may start working at age of 22, and it may not be possible for you to earn 15LPA as soon as you start working. Even if you start working with 4LPA, you can earn 15LPA by the age of 30. And most people will start to become serious about their expenses, savings, and future financial goals in their early 30s.

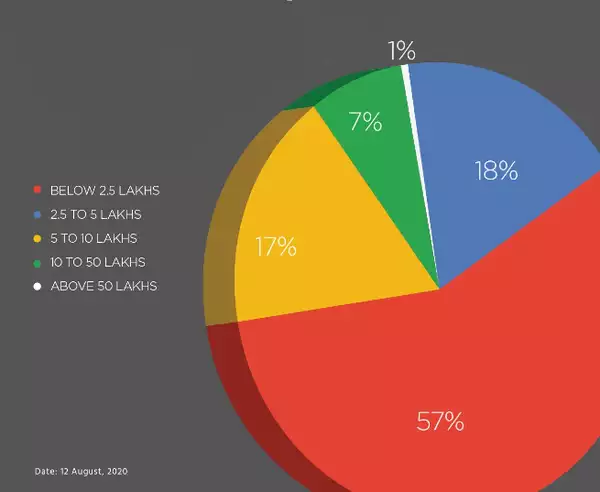

So for calculation purposes, assuming your earnings are around 15LPA by age 30, even if you start with nearly 4LPA at 22. Until you reach 15LPA at 30, your PF contribution could reach 5,00,000 INR. You can verify the same from various PF calculators available online. Also, you can find the calculators on this site in the future. After a certain % growth in your earnings, your salary can’t grow at the same rate, and according to Income Tax, only 1% of the taxpayers report earnings of more than 50 Lakhs. You can see the same in the image below.

Unlike fancy job profiles like Data Science, Blockchain developer, and Machine Learning, most people’s earnings fall in the range of 12LPA to 20LPA. Yes, there are people with more than 20LPA and also earn less than 12LPA, but let us keep things simple and settle at 15LPA for calculation purposes. Don’t worry, you will find the calculator to input your values and calculate for your retirement at the end of this series.

So, assuming your PF savings are around 5,00,000, and now you are at age 30 with earnings of 15LPA.

The calculation is shown in the image above. At age 30, with a 5,00,000 current EPF balance, with a total monthly EPF contribution of 9,793, your total EPF Contribution throughout your employment would be 40,25,750. With an 8.1% as Effective interest rate, you can retire at age of 60 with nearly 2.5 Crore Rupees.

That’s a huge sum of money.

Most people stop here with the expected retirement corpus of 2.5 Cr. But the reality needs to be further investigated.

How far the EPF Corpus is sufficient for you post-retirement?

Do you know that the 10,000 in 2020 is nearly equal to the 1,01,000 in 2050? I mean, if you have 10,000 in 2020, and if you have 1,01,000 in 2050, you have the same.

Do you know that if you have 87,000 in 2050, it is equal to the value of 10,000 today(2022) value? That means if you can purchase a product for 10,000 today you need nearly 87,000 in 2050 to purchase the same product. It is an effect of Inflation.

You will learn more about inflation later. But for now, if you spend 50,000 for your needs in a month today, after 30 years you need to spend nearly 5 Lakhs per month for the same needs yours.

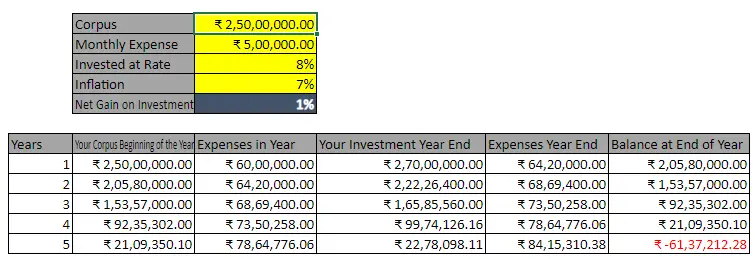

At the time of your retirement when you receive your retirement fund of 2.5 Cr, you will surely invest that amount in some kind of Fixed investment options like Fixed Deposits, Senior Citizen LIC Policies, or Post Office Schemes. At that age, you can’t take the risk of investing in risky options like stock markets or Cryptos. So the expected rate of return on your investment can be around 8%. The inflation is around 7% as of today. So, you earn 8% by investing, and you lose 7% by inflation. You just beat the inflation and earn only 1% on your investments. Even in the future if the inflation falls back to 6% or below, your interest rate from fixed investments also drops, so basically you can earn 1% on your retirement fund post-retirement.

Now let us see the calculations in the below image which shows how long your EPF retirement corpus of 2.5Cr is sufficient for your needs?

You can see from the above image that, the 2.5Cr of your retirement fund is only sufficient for 5 years of expenses post-retirement so finally you need to depend on someone for the rest of your life. Money is time. Your 2.5Cr is equal to 5 years of your time post-retirement.

So now you understand that EPF savings for your retirement alone are not sufficient for you post-retirement. What do you do now? Do you live below your means for your life and save for your retirement?

Will Living below your means help you?

Restricting yourself to live below your means has adverse effects at times when your friends or family expect from you. Your temptation to spend can be difficult to control when it comes to meeting your friends or family’s expectation. Living below means may not help you all the time but a frugal lifestyle may help you. Living below your means is like forcing yourself or restricting yourself to spend less even when your lifestyle demand more, but a frugal lifestyle is natural, your lifestyle itself has fewer expectations from your when it comes to your living expenses.

Understanding your lifestyle is critical in retirement planning. The modern lifestyle is expensive, Frugal lifestyle is affordable and supports your stress-free financial life.

A frugal lifestyle allows you to achieve financial freedom far more quickly. A frugal lifestyle is also a means to a happy and healthy life. But not everyone can live below their means. Some professions demand a high level of living expenses for various reasons Ex: Actors.

Conclusion

EPF is one of the great avenues for retirement planning, it is safe compared to others. But EPF alone may not sufficient for you after your retirement. Your expenses can come down after your retirement as well, which can buy you 2 to 4 more years. I don’t want to force living below one’s means, It should not be the case that you save for your retirement without enjoying your current life i.e., TODAY. Is it possible that without hurting today, can you still able to build a greater corpus for your investment?

The Answer is YES. It is possible when you start planning for your retirement early. You will get to know about this in the next post in this Retirement Planning Series.

Media Credits

Income Range Chart Source: timesofindia

All the information shared is for educational purposes only. The blog Finance Made Easy(financemadeeasy.in) and the author is not responsible for your financial decisions.

Sharing is caring!

Pingback: While having EPF do you need to invest in NPS even after investing in PPF for 15 years?

Pingback: Retirement Planning Series | Chapter 1 | Finance Made Easy