Sharing is caring!

Table of Contents

ToggleIntroduction

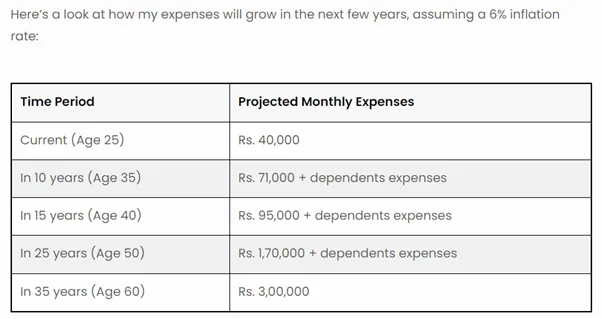

In my previous blog, I discussed calculating future expenses when my current monthly expenses are ₹40,000, assuming an inflation rate of 6%. By the time I turn 60, my projected monthly expenses would amount to ₹3 lakhs, with no dependent expenses. Now, let’s start with how to build the required retirement corpus.

How much corpus do I need to withdraw 3 Lacs monthly?

For this, we can find how much corpus is required with the help of the “Fixed Income Calculator”.

For example:

- If I retire at 60 and live till 80 (20 years), with an assumed return rate of 7%, I would need approximately ₹3.9 crore.

- If I expect to live longer, say 30 or 40 years, the corpus required will increase.

Example: Retirement Corpus Calculation for Different Life Expectancies

| Life Expectancy (Years) | Monthly Withdrawal (₹) | Return Assumed | Required Corpus (₹) |

|---|---|---|---|

| 20 years | 3,00,000 | 7% | 3.9 Crores |

| 30 years | 3,00,000 | 7% | 4.51 Crores |

| 40 years | 3,00,000 | 7% | 4.82 Crores |

You can use the “Fixed Income Calculator” to estimate the corpus based on your expected life expectancy and the return rate.

Now, how to build a corpus of 4 Crores for Retirement?

Once we know the required retirement corpus, the next step is to start accumulating the required retirement corpus.

There are several investment options to consider: Mutual Fund investing, Stock investing, EPF, PPF, and NPS (National Pension Scheme).

But for retirement planning, we have EPF and NPS but due to the new early retirement, I can’t depend fully on EPF, and I really can’t avoid NPS(National Pension Scheme).

Why Choose NPS for Retirement?

For retirement, we do have popular products EPF and NPS. Since my focus is on achieving Financial Independence and Retiring Early (FIRE) by age 40. I prefer NPS for long-term wealth accumulation to fund my post-60. So that I can focus more on periods 40 to 60 actively, and choose NPS to take care of later.

NPS offers a relatively safer option with a mix of equity and government-backed instruments. Strict rules on withdrawal allow compounding to do wonders, Its low-cost structure. So, I am looking for NPS to build a secure retirement corpus.

NPS historical returns suggest that equity-heavy allocations can yield around 10% to 12% annually. For example, a mix of 75% in equity, 20% in government bonds, and 5% in alternative assets has shown attractive returns. While the returns may vary over time, aiming for a long-term return of 10-12% is reasonable, especially when planning for retirement or FIRE.

Choosing the right product for the right goal is also important.

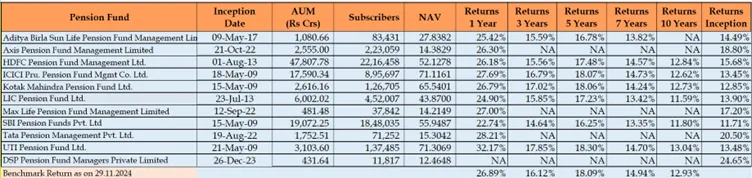

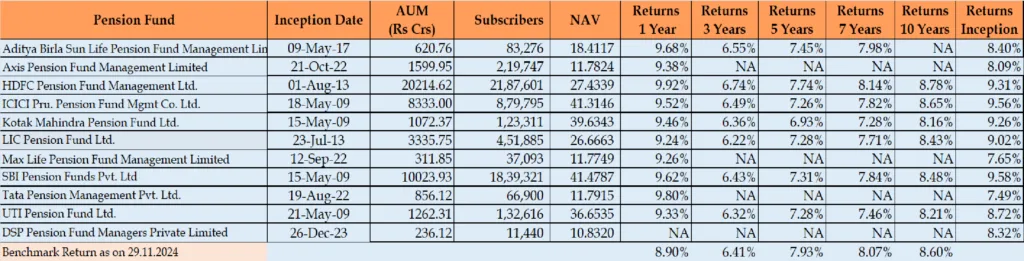

What are the Returns from NPS?

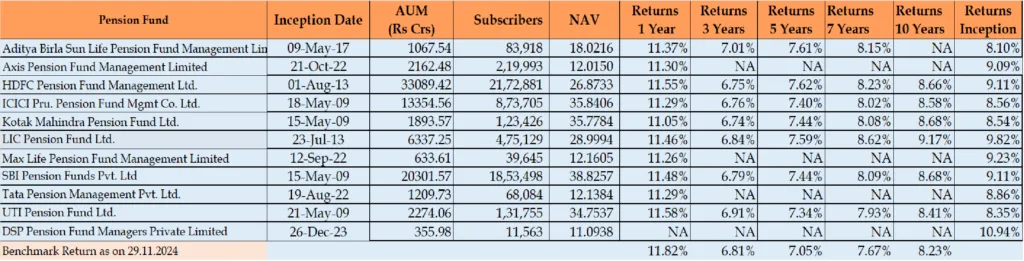

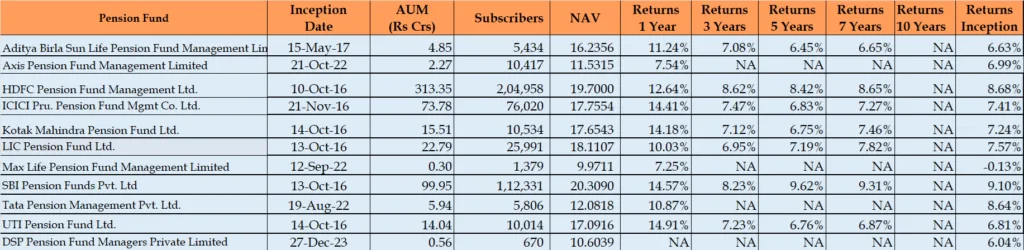

You can find the historical returns from NPS in the image below.

Based on these returns, investing in NPS with an equity-heavy allocation can offer decent long-term growth for retirement.

If you are following the FIRE category, I already discussed how much we can expect from the Equity portfolio here.

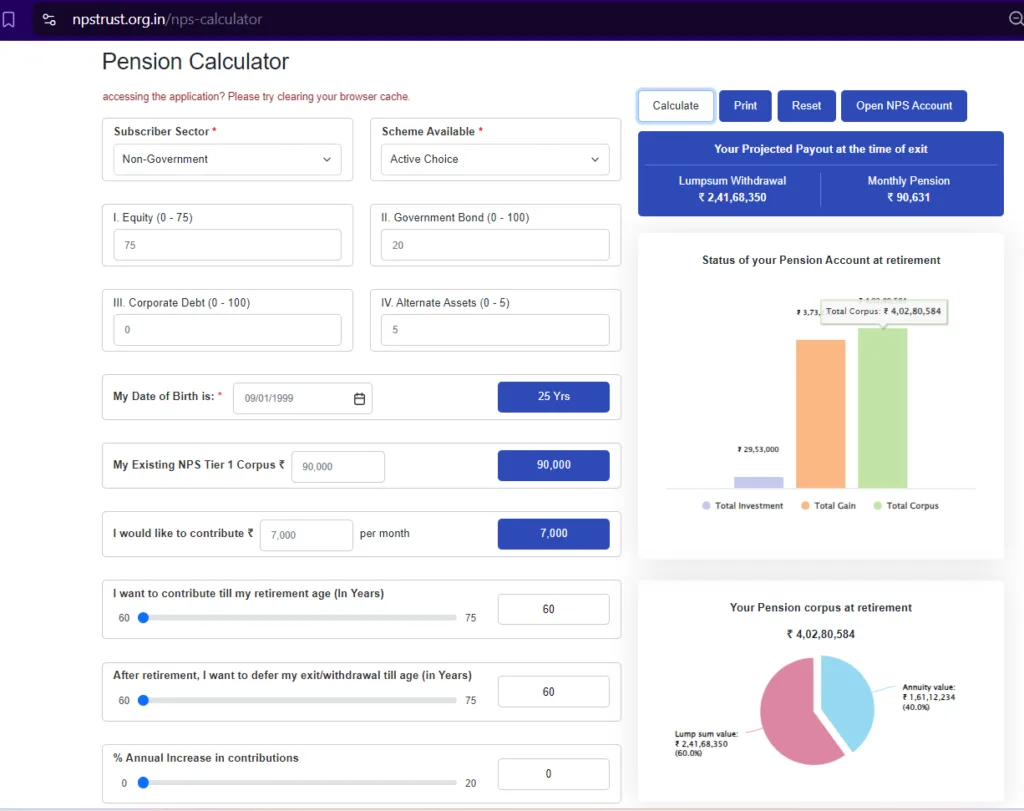

Now, I have decided on my investment product, have reasonable assumption on expected returns, and required corpus, so I can calculate the from the NPS calculator from the official site here.

How Much to Invest in NPS to Reach ₹4 Crore?

Based on current calculations, to build a corpus of ₹4 crore by age 60, I would need to invest ₹7,000 per month starting now, assuming a 12% return.

However, I’m planning for an early retirement at age 40. So, how do I build a retirement corpus without contributing after 40?

The Early Retirement Challenge: How Much Should You Have at 40?

Since I want to stop contributing at age 40 and still reach ₹4 crore by age 60, I need to accumulate a sufficient corpus by age 40. Based on the same 12% return, here’s how much corpus I’d need at different ages to achieve my goal of ₹4 crore:

Example: Corpus Needed for Retirement at Different Ages

| Age | Corpus Needed (₹) | Investment Period (Years) | Expected Return |

|---|---|---|---|

| 25 | 7.5 Lakh | 35 | 12% |

| 30 | 14 Lakh | 30 | 12% |

| 35 | 24 Lakh | 25 | 12% |

| 40 | 45 Lakh | 20 | 12% |

| 45 | 80 Lakh | 15 | 12% |

| 50 | 1.5 Crore | 10 | 12% |

| 55 | 2.3 Crore | 5 | 12% |

If I have 7.5 Lakh today, will I invest in NPS?

By the table, it is clear that the sooner I invest sufficient corpus in NPS, I no longer need to worry about my retirement fund.

So, Will I invest in NPS now the required 7.5 Lakhs? Surprisingly I decided not to invest in NPS but I can opt to invest in other mutual funds for other goals.

The reason is simple, NPS is one of the tax efficient investment options. I would rather opt for Corporate NPS as long as I can and get the tax advantage instead of investing all at once.

Just a remainder for myself, even if I invest all the required amount now or contribute regularly to my NPS, my end goal Is to have sufficient corpus by age 60.

No matter what route I take, I would like to take as much as advantage I can get in my journey.

Tax Planning for NPS

OLD TAX REGIME: For example, contributions to NPS are eligible for an additional ₹50,000 deduction under Section 80CCD(1B), over and above the ₹1.5 lakh limit of Section 80C. This tax saving can help you invest more towards your retirement goal, accelerating the growth of your retirement corpus.

NEW TAX REGIME: You can contribute upto 14% of basic salary towards NPS and get tax benefits.

Sharing is caring!