Sharing is caring!

In this blog we will discuss on how do you assess the financial health of the company to fulfil its short-term financial obligation with liquidity ratios. We’ll explore key ratios that offer insights into a company’s liquidity status and the implications of both low and high values for these ratios.

Liquidity ratio:

These ratios are used to assess the financial health of the company to fulfil its short-term financial obligation.

- Current Ratio

- Quick Ratio

Introduction Current Ratio:

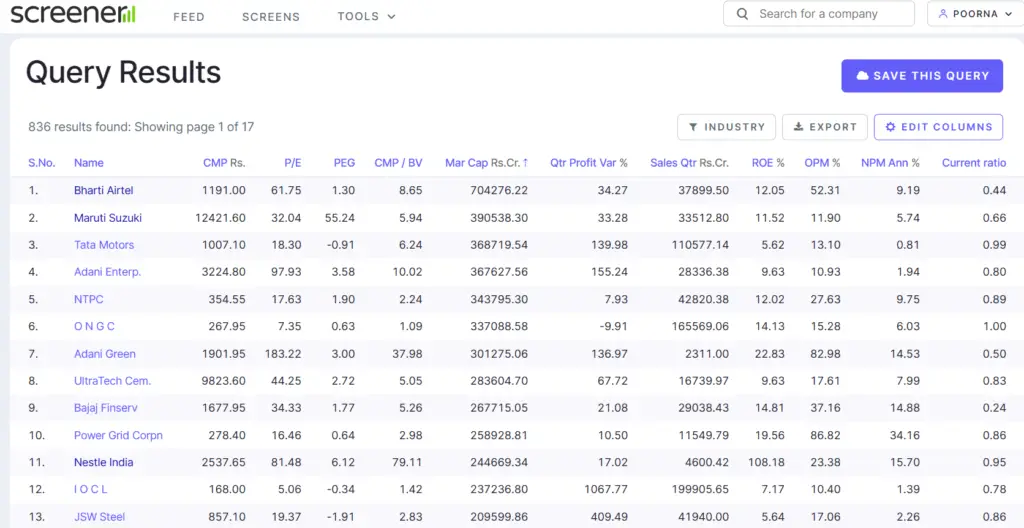

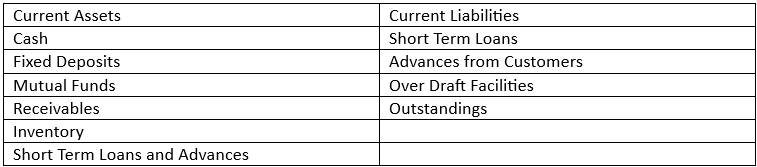

This ratio measures a company’s ability to pay its short-term obligations with its short-term assets. It is calculated by dividing current assets by current liabilities.

A ratio above 1 indicates that a company has more current assets than current liabilities, which is generally considered favorable.

In the domain of financial analysis, preferred range for current ratio is > 1.33 and < 3

Table of Contents

ToggleWhat does it mean if current ratio is less than 1?

When the current ratio is less than 1 it means, company has more liabilities than assets and may face challenges to fulfil its short-term obligations to keep the company running.

Of course, there are many top companies that doesn’t like cash in their balance sheet idle, maintains the current ratio less than 1. Range of 0.75 to 1 is also fine for such companies.

Later, the company need to pay its current liabilities from its cashflows.

What can companies do when their current ratio is less than 1?

In such cases, the company may need to explore alternative measures to address its liquidity concerns and fulfill its current liabilities.

Company can follow following strategies to solve their liquidity issue:

- Generating cashflows: accelerating the collection of accounts receivable, delaying payments to suppliers (within reasonable terms), or selling non-core assets to raise funds.

- Short Term Financing: may seek short-term financing options, such as lines of credit, bank loans, or issuing commercial paper

- Asset Sales, Capital Infusion, Cost Cutting, Debt Restructuring

What does it mean if current ratio is more than 3?

Whenever the company’s current ratio exceeds 3, it is crucial to identify the reasons behind the unusually high level of current assets.

It is not always only the cash component that drives the current ratio higher; inventory and trade receivables are also factored into the calculation.

An increase in inventory or outstanding trade receivables can significantly impact the current ratio. It’s important to closely monitor whether the company is able to sell its inventory(Check inventory days) and collect pending trade receivables.

In simpler terms, a current ratio exceeding 3 suggests management inefficiency. The surplus cash sitting idle in the balance sheet affects return ratios (which we will discuss in our analysis of profitability ratios) and consequently impacts overall returns from the stock price.

Conveting Inventory into sales, and waiting for the creditors to repay takes time, and most financial analyst prefer not to look at inventory in assessing the liquidity of the company, hence we look also look at quick ratio.

Introduction to Quick Ratio:

This ratio is a strict measure of liquidity as it excludes inventory from current assets. It is calculated by subtracting inventory from current assets and dividing the result by current liabilities.

In short, quick ratio only takes into account the assets that can quickly convertible into cash.

A higher quick ratio suggests a stronger ability to meet short-term obligations.

Ideal range for quick ratio is 1 to 2.5, anything lower means company struggling to pay its short term obligations, and anything higher means it has some management inefficiencies managing the cash.

Examples:

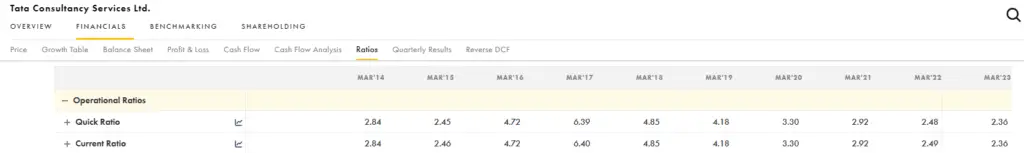

We observe that the Current Ratio and Quick Ratio for TCS are nearly identical. This is attributed to the fact that IT companies typically do not maintain inventory.

In contrast, for Tata Chemicals, the Current Ratio is higher than the Quick Ratio, reflecting the presence of inventory in their business operations, which involves the sale of products.

Conclusion:

By examining liquidity ratios, investors, creditors, and analysts can gain a deeper understanding of a company’s liquidity position and make well-informed decisions regarding investment, lending, and risk assessment.

In short, We have current ratio and quick ratios to assess the liquidity status of the company, we had discussed if the company current ratio < 1 suffers fulfilling its short term obligation, if current ratio > 3 results inefficient management either by inefficiency in cash allocation or inventory management or by reciveables.

Also, In our next blog, lets discuss on why some top companies as seen above maintain current ratio less than 1 even less than 0.5 and how they fulfil their short term financial obligations.

To read more on retirement planning please click here

All the information shared is for educational purposes only. The blog Finance Made Easy(financemadeeasy.in) and the author is not responsible for your financial decisions.

Sharing is caring!