Sharing is caring!

In our previous blog, we have introduced to the concept of coffee can investing in detail. Now in this blog we will assess the performance of the coffee can portfolio created as of August 30, 2017, as discussed in the book “Coffee Can Investing”.

Table of Contents

ToggleCoffee Can Portfolio Case Study:

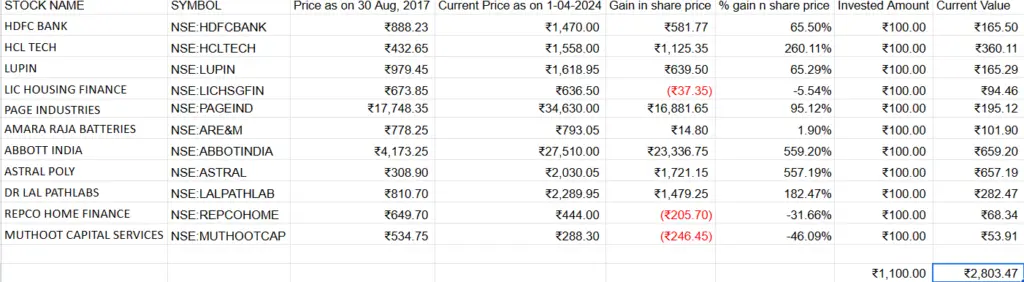

Below there is a list of stocks that has picked by the coffee can portfolio as on August 30, 2017.

| HDFC BANK |

|---|

| HCL TECH |

| LUPIN |

| LIC HOUSING FINANCE |

| PAGE INDUSTRIES |

| GRUH FINANCE |

| AMARA RAJA BATTERIES |

|---|

| ABBOTT INDIA |

| ASTRAL POLY |

| DR LAL PATHLABS |

| REPCO HOME FINANCE |

| MUTHOOT CAPITAL SERVICES |

As of today, GRUH FINANCE has undergone a merger and is no longer actively traded on the exchange.

The last traded price of the stock was recorded on October 14, 2019, at 317. Its entry price was approximately 259 on August 30, 2017, resulting in a calculated compound annual growth rate (CAGR) of 10% over the two-year period.

For the purpose of evaluating our portfolio performance up to the present day, we will exclude this particular stock.

Coffee Can Portfolio Performance

The table above provides a comparison of various stocks’ performance from August 30, 2017, to April 1, 2024.

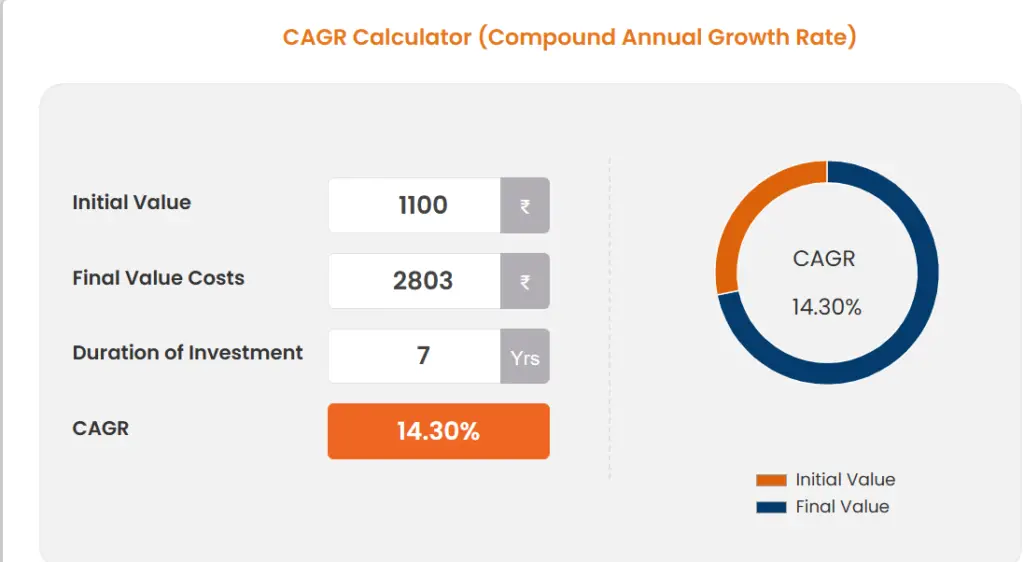

During the same period of time, Nifty rise from 9885 to 22462 over the span of 7 years(August 2024 is 4 months short at this point of time) that is 12.44% CAGR.

At the same time Coffee can portfolio has delivered 14.23% CAGR outperformed NIFTY Index by 1.79%.

In the book “Coffee Can Investing,” the author meticulously outlines the performance of several coffee can portfolios. It’s evident that across numerous instances, these portfolios have consistently delivered outstanding performance, surpassing expectations.

Note: As of today, it’s worth mentioning that some stocks have experienced a decline in their Return on Capital Employed (ROCE) and sales growth. However, it’s worth mentioning that the author did not address the rebalancing aspect of these portfolios or any exit conditions.

We will explore exit conditions in upcoming blog posts.

Additionally, you’ll notice that HDFC BANK is included in the portfolio discussed above. As stated in our previous blog, our criteria for Banks and Non-Banking Financial Companies (NBFCs) is Return on Equity (ROE) > 15% rather than focusing on ROCE.

Now, let us discuss the burning question

Why Should we choose sales growth and ROCE as the metric for selecting high-quality stocks?

Why ROCE?

A Company invests its capital (Equity + debt) to generate revenue and ROCE is a metric that measures the efficiency of capital deployed. In simple words, higher the ROCE higher the better the company uses its capital.

And we look for the stocks whose ROCE > 15% because it’s the minimum return required for the risk.

Why sales growth?

We expect a company to grow by the GDP growth of the country. So, we take companies that are growing by 10% in last 10 years.

What if we enter at the high valuations?

The author mentions – “Starting investment period valuation has little impact on the long term gains.”

What if we exit stocks at high valuation and re-enter?

Again, this also doesn’t provide any better returns than our original “buy and hold” strategy. As we can’t time the markets, it better to stick with our basic rules.

Sharing is caring!

Pingback: How to Navigate a Bear Market: 7 Proven Strategies Explained