Sharing is caring!

Table of Contents

ToggleIntroduction to Impact of Unemployment on Stock Markets

Before understanding the impact of unemployment on stock market, Lets first recollect how the stock prices are priced. On intraday basis stock price depends on the supply and demand(discussed here), But on positional basis stock prices are priced considering the current valuations of the stock, earnings release, future commentary by the management.

There are external factors that will impact the stock prices too, the macro economic data including the inflation, CPI, WPI, Industrial Production Data, Crude Oil price, Currency strength against USD, interest rates and Unemployement data.

Now in this blog post we discuss about unemployment impact on stocks.

Is Unemployment Good or Bad for stock market?

Unemployment is always bad for the people. But stock prices react different at different times. For instance, on 3rd June 2022, the US Unemployment data for May month was out where unemployment holds at 3.6%, adds 390,000 Jobs.

Which is strong than the market expectation, but the market did not react so positive, instead the markets were under pressure. And there are times where stock gain when there is rise in unemployment rate(poor employment condition).

Rising unemployment is “Good News” for stocks during economic expansion and “Bad News” during economic contraction.

Lets us understand why.

What happens when Unemployment increase?

When unemployment in a country is increasing, people generally spend on the items that they need and avoid discretionary spending, that results less revenue for companies, and that inturn results in less profits and less growth for companies.

But why do some stocks react positively knowing companies would post poor results in upcoming quarters? The answer lies in the RBI reaction to this situation and the economic situation currently we are in. Before answering this question, lets see the case of decreasing unemployment.

What happens when Unemployement decrease?

When Unemployement reducing, it means the earnings of people in the country is growing, that results in increase in discretionary spending on food, credit cards, electronics, may take a home loans to build homes, personal loans for vacations etc.

That results in high revenue for companies resulting in high profit growth. Sometimes it is possible that the stocks neither react positive nor negative for this news.

What does RBI do?

RBI reaction to the unemployment situation may vary depending on Inflation data.

Let us assume, the inflation at Consumer level CPI, is high, and the unemployment is low. This means, people earnings is improving and at the same time inflation is also high.

In this situation to meet the raising demand from the peoples spending on discretionary spends, and since the high input cost for companies due to inflation, the companies go for price hikes for their products to pass on their input cost of raw materials to customers, this further drives the inflation high at consumer level.

To control inflation, the RBI can go for interest rate hikes. The interest rate hike typically reduces the supply of money to people, companies by making the cost of credit look high, causing the people and companies to reduce taking loans. This reduces spending of people that draws the demand down, and for companies due to less demand they try to optimize their production than increasing the supply, and the companies would sell their products at reasonable lower prices resulting the lower inflation.

This interest rate hike reduces the availability of credit/loans to people to purchase, and this reduces the future revenue of companies. The stock market anticipates this before and react accordingly. This is exactly what happens every time unemployment data is published better than expectations in an high inflation environment. This is exactly what happened with the May month unemployment data. Since unemployment is low during May, 2022. And the inflation is high at this point. The markets expect that there is possibilly a interest rate hike by RBI to control inflation and prices the stocks accordingly. And on 8th June, 2022, the RBI Hike interest rates by 50 basis points.

Now, let us assure another situation, where the unemployment is raising. Generally, In raising unemployment situation, we cannot expect the inflation is high, because of the inverse relationship between unemployment and inflation, that you should hava been understanding by the previous discussion we had in this blog.

Lets see how the RBI tackles this situation.

Due to unemployment the supply of money is less with people, and the companies struggle to make their sales and their revenues would be low. This impact our economy badly, since due to the less sales for companies the tax to paid by companies will be less, since there is less spending by people there is less GST collections for the government.

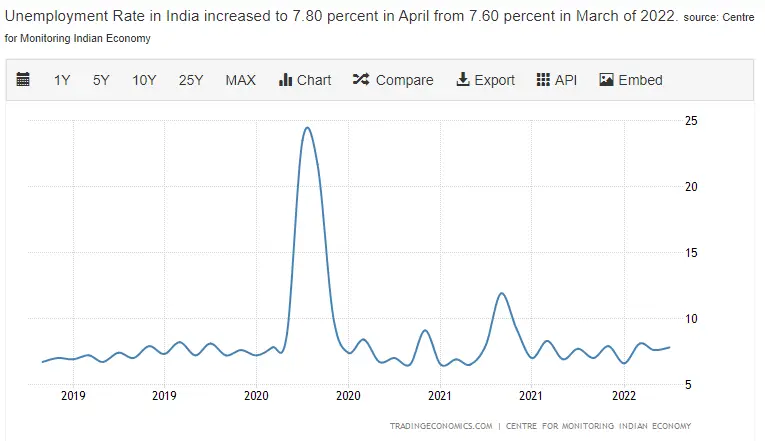

To boost the economy, the RBI will cut the interest rates, in the hope due to less interest rates, the cost for credit will be cheap, so people and companies would maintain liquidity and based on the severity of unemployment the RBI would also choose an option to print money and pump into the economy. This we have seen during the COVID crisis that caused decades high unemployment.

Conclusion

By this discussion now, you possibly understand that the main driver for stock market reaction to unemployment is mainly because of the possible steps taken by RBI to control inflation. And the Unemployment data is one of the metrics to consider for interest rate changes by RBI.

On final note, the discussion made in this blog is based on Indian context. But, we track U.S unemployment data too. This is mainly because most of the time our markets follow the trend of U.S Stocks since U.S being a developed nation, and our Indian companies too do sales in U.S and their macroeconomic data impact the sales of our companies directly.

All the information shared is for educational purposes only. The blog Finance Made Easy(financemadeeasy.in) and the author is not responsible for your financial decisions.

Image credits by freepik

Sharing is caring!