Sharing is caring!

Table of Contents

ToggleIntroduction to FIRE planning:

Context:

Welcome to our FIRE series! In this series of blogs, we are discussing FIRE planning, I will be starting with FIRE planning for 25-year-old or in short, I’ll share my thought process and approach towards FIRE @40, and also, I will keep milestones for ages 30, 35, 40, 45, 50, 55, 60 so that this series of blogs will be helpful for readers at different stages of life.

To get the most out of this FIRE series, I strongly recommend reading the first 4 blogs. In these blogs, I discuss where we currently stand economically and socially when it comes to retirement. I also cover the real challenges in making FIRE planning work. These blogs will help clear your doubts about whether FIRE really works and address some important questions.

For example, with early retirement, you are exposing yourself to a much longer retirement life 30 to 40 years, have you ever wondered, if your corpus lasts for that long? What if the stock market does not perform as expected? What if inflation is higher than expected? What if the stock market stays sideways like Japan for decades?

In this blog, let us start with assessing future expenses based on current monthly expenses.

Step 1: What are my expenses for basic needs?

Here this is a problem. Twenty years ago, most families had one mobile phone for the house, but today, every person in the family needs their own phone. It’s hard to predict what our lifestyle and needs will be 35 years from now, so predicting future expenses can be difficult.

But it is important to understand how much I am spending today and where I am spending my money. I spend on many different things, some of which may not be needed when I retire. For example, I may not eat out or travel as much after I retire. To start planning for FIRE (Financial Independence, Retire Early), it’s good to have a rough idea of how much I might spend during my retirement years.

So, the first step is to make reasonable guesses about what I will spend and calculate those costs. It is equally important to understand that these can change over time and you need to review your expenses when you are nearing retirement.

Step 2: Projecting my expenses when I am 60

Let’s say I am 25 years old today. The next step is to estimate how much my expenses will be when I am 60. To do this, I will take my current expenses and inflate them each year until I reach 60.

| Current Expenses Breakdown | |

|---|---|

| Category | Current Monthly Expense (Rs.) |

| Basic Needs (e.g., groceries, utilities) | 20,000 |

| Insurance | 5,500 |

| Dining Out | 5,000 |

| Healthcare | 5,000 |

| Bills (e.g., electricity, water) | 3,500 |

| Miscellaneous | 1,000 |

| Total Monthly Expenses | 40,000 |

For the above expenses, I need to find what are my future expenses at age 60, But what is the effective inflation?

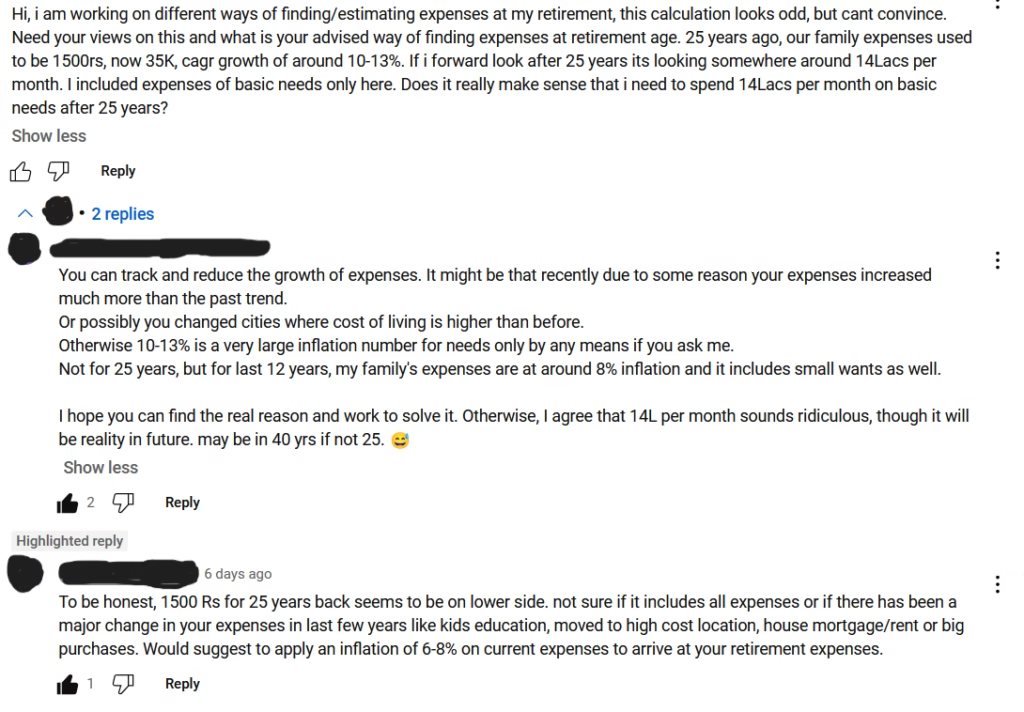

Let me just think of how my family expenses changed over the past 20 to 25 years. My family used to spend Rs. 1500 – Rs.2000 monthly, and today, we spend around Rs. 40,000 a month, which is around 12.73% effective inflation.

If I inflate the current expenses for the next 35 years at a rate of 13%, my monthly expenses will be 17 Lac per month. Even a 2 Crore corpus will not last more than a year. Isn’t it really ridiculous

So, what is the real inflation I can consider?

If I examine a bit in detail, In the past, we didn’t have a landline, personal vehicle, or insurance. We didn’t eat out much either. But today, all of these things are part of my regular life. The definition of our needs has been changed a lot now.

I had a closer look at this inflation effects on my future expenses at my retirement, and I am comfortable taking long-term inflation between 6% to 8%. To be sharper, I am comfortable taking long-term inflation as 5% too.

- RBI’s inflation estimates: According to the Reserve Bank of India (RBI), long-term inflation in India is usually around 4%, with some variation. The standard inflation rate is between 2% and 6%. However, personal inflation can be higher due to lifestyle changes(we have seen my family expenses over the past 25 years as an example)

- FIRE community: Based on my discussions with the FIRE (Financial Independence, Retire Early) community, I found that a lower inflation rate is more realistic for long-term planning.

Excluding all other lifestyle expenses such as insurance, dining out, and other miscellaneous costs we have today, it assumes that the inflation on the needs we had 25 years ago has increased by 7.2% Only. Hence considering 6% inflation for calculation purposes.

Key Notes:

- I need to re-examine my expenses when I am nearing my retirement and how inflation impacted me.

- Childcare expenses or dependent expenses, will not be part of my expenses at the time of retirement, hopefully, children will start living on their own.

- It is more important to live in your own house than to rent.

- I am not worried about inflation being higher, because as discussed in the previous blog, healthy inflation is often good and as long as I have some equity exposure my corpus could beat inflation, and I need to be focused more on my lifestyle expenses and keep them under control.

- Given that, our basic definition of needs changed over time, it is supposed to be changed again in the next 35 years

Adjusted Future Expenses with 6% Inflation Rate

Now, assuming a more conservative 6% inflation rate, let’s see how my expenses would look after 35 years.

| Expense Category | Projected Monthly Expense (Rs.) |

|---|---|

| Basic Needs (e.g., groceries, utilities) | Rs. 121,963 |

| Insurance | Rs. 33,759 |

| Dining Out | Rs. 30,690 |

| Healthcare | Rs. 30,690 |

| Bills (e.g., electricity, water) | Rs. 21,483 |

| Miscellaneous | Rs. 6,139 |

| Total Monthly Expenses | Rs. 244,725 |

These are expenses to lead my current lifestyle after my retirement excluding other dependent expenses like children’s education, knowing that dependent expenses will be impacted between age 40 to 60 years.

Estimating My Future Expenses Over Time

Here’s a look at how my expenses will grow in the next few years, assuming a 6% inflation rate:

| Time Period | Projected Monthly Expenses |

|---|---|

| Current (Age 25) | Rs. 40,000 |

| In 10 years (Age 35) | Rs. 71,000 + dependents expenses |

| In 15 years (Age 40) | Rs. 95,000 + dependents expenses |

| In 25 years (Age 50) | Rs. 1,70,000 + dependents expenses |

| In 35 years (Age 60) | Rs. 3,00,000 |

Hope this blog helps you to calculate and gives you an idea of planning your expenses for the future. Once you have a clear idea of the amount you’ll likely need, you’re ready to start selecting investment products to achieve your financial goals. In our upcoming blogs, we’ll focus on choosing the right investment options and planning our FIRE (Financial Independence, Retire Early) journey.

All the information shared is for educational purposes only. The blog Finance Made Easy(financemadeeasy.in) and the author is not responsible for your financial decisions.

Support us by following and Subscribing

FinanceMadeEasy – YouTube

Instagram

Do you want to learn more about finance please read all our blogs which contain huge amount of information about finance and money management click here to go to home page. Go through our homepage and learn more about boring finance topics which give huge information, of course it is valuable content to lead life peacefully without financial hurdles.

Sharing is caring!