Sharing is caring!

From this chapter onwards you will learn about retirement planning in an actionable way. Till now Chapters 1, 2, and 3 try to address retirement in emotional aspects and how it affects if you fail to plan your retirement. This chapter is relatively short and easy to consume for reader(i.e., you), each of the step discussed in this chapter is further discussed in great detail in next chapters.

By reading the preceding chapters you get to know the importance of retirement planning and starting early. Let us go through the steps involved in retirement planning in this chapter.

The goal is not Retirement but Financial freedom.

Step 1: Tracking & Budgeting

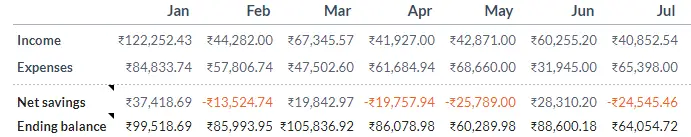

You always have a rough calculation in your mind about where you are spending your money. But there will be a lot of difference between your estimation and reality, that you only know when you start tracking every rupee.

Once you start tracking all your income and expenses. You now have a documented list of your income and expenses. Once you done tracking, its time to calculate your monthly fixed expenses.

You need to track at least 6 months of your monthly expenses on an average. If you only track your expenses for a month it may mislead your whole calculations.

Step 2: Calculate your monthly fixed expenses

Fixed expenses are the money you spend on your needs like rent, food, bills, insurance, etc.

Having all your monthly expenses sorted now you need to deduct some of the expenses like, investments you make, loan EMI’s you pay, Life Insurance if you have one, and child care expenses.

Reason being after you retire most probably you may not need to invest, no life insurance payments because no one is dependend on your income, no education or marriage expenses as your children may not be depended on you, and hopefully no loan burden on you.

Total Monthly Expenses – Sum of expenses on Life insurance, loan EMIs, Investments, = Fixed Expenses.

For example, If your expense is 60,000 Rs per month you pay 1000 Rs for life cover, and 11,000 Rs on child care and education. 3000 Rs towards loan EMIs and you invest 5000 Rs.

Total fixed expenses for you is: 40,000 Rs (60,000 Rs minus(-) above mentioned expenses).

Step 3: Value of your fixed expenses at the time of your retirement

In the example discussed above, you are spending 40,000 on your basic need that you need to spend for the rest of your life.

So will you be spending the same 40,000 Rs after you retire for the same standard of living?

No, taking inflation into account, to maintain the same standard of lifestyle you need to spend 2.3 Lakhs per month. (Assuming inflation at 6%, and your age 30).

Step 4: Calculate your requried retirement corpus

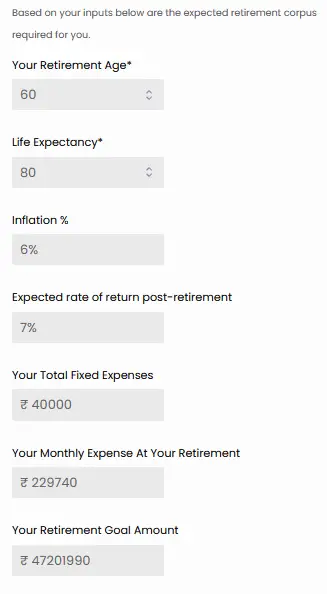

Assuming your age is 30, and you retire at 60. At 60, now you know your monthly expenses are nearly 2.3 Lakhs.

To answer what is the retirement corpus you need? You need to answer your expected life expectancy. So for calculation purposes assuming life expectancy is up to 80.

Calculation of the required corpus for retirement include a bit of math, but to make it simple there is a thumb rule for the amount of retirement corpus you need.

Required Corpus = Future monthly expense x 20.

This rule works quite efficiently, but to get the exact amount you need to use the calculator provided here.

If your monthly expenses are 40,000 Rs now, it will be nearly 2.3 Lakhs per month at the time of your retirement. And the retirement corpus required for you at the age of 60 is 20 * (monthly expense * 12). Which is equal to 5.5 Crores.

By this way, you can calculate the target amount that you need to achieve by the time of your retirement. How to achieve or build your retirement corpus of 5.5 Crores will be discussed in the next chapter.

Exercise For You !

Here is an exercise for you. Try to calculate the retirement corpus you required for your post-retirement life.

To make it easy. Use the Advanced Retirement Calculator to know how much retirement corpus you need at the age of your retirement.

Note: Income and Expenses are individual to every person. So the calculations shown in the post are for example only. So use the Advanced retirement calculator tool to input your income and expenses to get the appropriate retirement corpus needed for you.

All the information shared is for educational purposes only. The blog Finance Made Easy(financemadeeasy.in) and the author is not responsible for your financial decisions.

Sharing is caring!