Sharing is caring!

Are you planning to go to the US to earn in dollars? Telling you upfront you are right, earning in dollars has a great advantage for the same amount of effort you put in your work here. But I think you need to reconsider your decision to go to the US. Don’t you forget, If you are in earning in dollars you need to spend in dollars?

If you are going to the US to explore then there is no doubt you should go to the US. But if you are going to the US for earning, then there is something you need to consider. Will explore the same in this blog post. Do you know that you are rich than your friend in the US? It is true. You will find out how in this blog post.

In this blog post, for the comparison, it is between you and your friend in the US in terms of income and expenses and finally savings. In the end, I will provide you with the Excel sheet to compare on your own. Before going forward there is something you need to learn. The concept of purchasing power priority.

Table of Contents

ToggleWhat is Purchasing Power Priority (PPP)?

Whatever a basket of goods and services costs in a country when converted to another currency you should be able to buy the same level of goods and services in that foreign country. It is just a theory that most economists use to compare two country currencies.

For Example,

If for $1000 in the US you get a basket of goods, you converted it into Indian Rupees, you get ₹2000, and you also get the same basket of goods. Here exchange rate(real) is 1:2($1 = ₹2), for every dollar you get ₹2 Indian Rupees. Now, in India, due to inflation the prices of goods became high, and the price of the same basket of goods is now ₹2500. If you convert the $1000 to INR, you get the same ₹2000, as per the exchange rate, All of a sudden, you can’t afford the same goods anymore. It means it no longer reflects purchasing power priority. Now, the exchange rate $1 = ₹2 becomes the nominal exchange rate, not the real exchange rate. Now India became expensive. The rupee became overvalued against the dollar.

Economists need a real exchange rate for comparing currencies, which is $1 = ₹2.5. This is called as real exchange rate($1=₹2.5) reflects PPP, the nominal exchange rate doesn’t reflect PPP.

Present Value Of Purchasing Power Priority

Now cut the discussion here, the key takeaway from this concept is, that there is something called purchasing power priority which tells you what is the amount of foreign currency you need to maintain the same standard of living in that country.

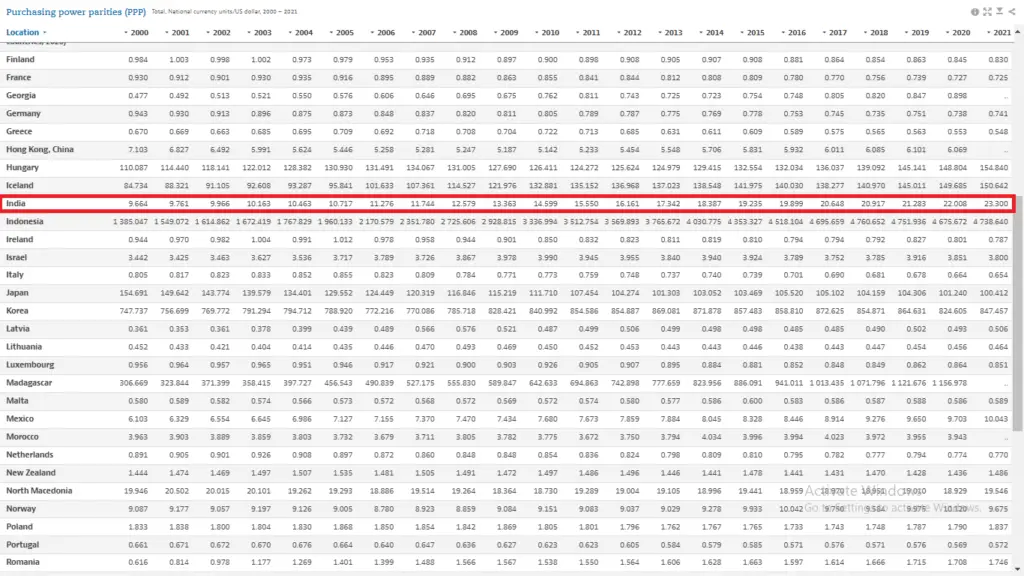

The PPP value of INR against USD in 2021, is 23.30. I.e, $1 = ₹23.30. Refer to below image.

This means if you need ₹30,000 to purchase a basket of goods in India, your friend needs $1287.55 (₹30,000/23.30) to purchase the same basket of goods in the US.

What Are The Possible Earnings In The US?

As per the Business-Standards report published on 25 Aug 2021, The median family earnings of Indians in the US is $123,700, nearly double the nationwide average of $63,922.

Earning the median salary of $123,700 can take up to 6 years of work experience and need highly technical expertise though, and if your friend is just started working his/her earnings probably start with $60,000 (which you have heard like your friend is earning 4 lakhs per month). And, most people’s earnings(70%) may fall in the range of $70,000 to $120,000.

Please note, that your friend’s earnings highly depend on the domain he is working on and his/her skill set, also the median family earnings given in the report may include working wife and husband. So, as I said earlier, I will provide you with an Excel sheet to calculate or compare income, expenses, and savings.

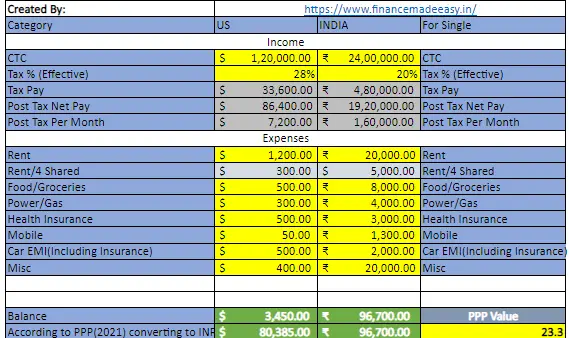

For the calculation and comparing purpose, consider your friend’s CTC in the US is $120,000, and your CTC as ₹24 Lakhs.

Calculating Income, Expense, and Savings

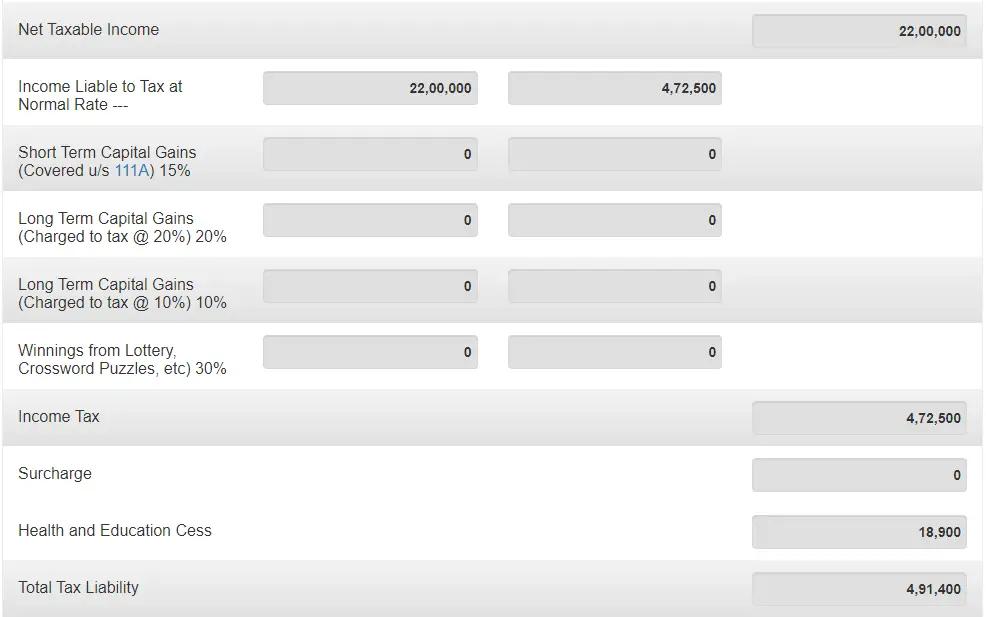

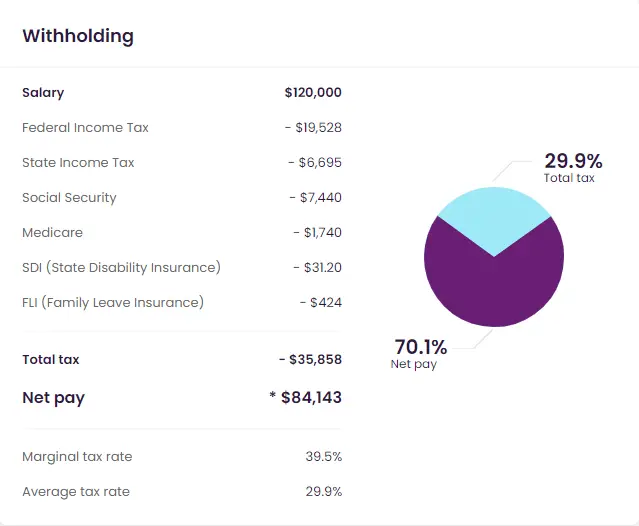

The CTC in your offer letter doesn’t reflect in your bank account, The effective tax rate is taken as 28% for the US, and 20% for India. Taxation is a complicated subject, and Just taking the approx effective tax rate, and to know the approx tax, you can use the many online tools like tax calculators for India and US.

As I am providing you the excel you can input the effective tax rate that applies to you, and the expenses that apply to you, but as of now, consider the most common applicable tax and expenses for calculation.

Update:

1. After converting the $3450 in rupees as per PPP, the currency is showing as $ where it should be Rupees.

2. Car EMI 2,000 is wrong. It can be Insurance for your bike. (Where bike is necessary and everyone usually pays their bike insurance).

You can edit the yellow cells to input your appropriate values.

As you can see with 24 LPA CTC by the end of the month after spending on all your basic needs you still have money more than your friend earning $120,000(nearly 1 Cr in INR) after his/her expenses.

The conclusion here is simple, as long as your friend is living in the US, you both spend the same for the same standard of living, and save the same amount of money.

When the person comes back to India the currency conversion is as per the exchange rate(USDINR) and not as per the PPP, so somehow it is an advantage for the person who plans to come back to India, but there is a catch with it which is out of the scope of our discussion here like not greater attention to people with a masters degree hence forced to work and settle in the US only, visa issues, and other emotional aspects.

Are You A Student Planning To Go To The US?

If you are a student planning to study abroad, I am not discouraging you, what I want to tell you is if you just want to go to the US only to earn dollars, then you need to reconsider your decision considering the other factors that affect you. If you want to explore the US and Graduate from a top university in the US, or if you are a research interest then no doubt you can just go forward.

Also, you can use the excel sheet provided to compare your income in India to your potential income if you migrate to the US and make a better decision.

Conclusion

Final Question for you, is your needs and your friend’s needs are same? Or are your wants are same as your friend’s? Then why is that you need to earn more than your friend? Both are in different boats of life. I like to remind you, “Life Is The Most Difficult Exam, Many People Fail Because They Try To Copy Others.”

The comparison should be between you and your past self.

Share this with your US friend, and let them know not to stress too much about money and explore the US and its culture.

All the information shared is for educational purposes only. The blog Finance Made Easy(financemadeeasy.in) and the author is not responsible for your financial decisions.

Sharing is caring!

Pingback: Why Rupee Is Falling? Who Decides Exchange Rate? Its Effect On You?