Sharing is caring!

Table of Contents

ToggleIntroduction to FIRE

Earlier we have discussed briefly about retirement planning and options available for retirement planning. Now, millennials and Gen-z are actually chasing new fashion of retirement called Financial Independence Retire Early (FIRE), trying to get financially free at early age and get out of 9-5 corporate life and live on their own terms.

We will start discussing on this new retirement trend from now on, but it is equally important to understand the current situation where we stand in terms of traditional retirement.

Now, in this blog I will try to discuss on 4 economic aspects around retirement and where we stand. This observation I feel is really important for planning for FIRE.

Worldwide, Retirement Ages Are on the Rise

Retirement age in India is around 60 and some states increased to 62 years for state government employees and private sector employees have retirement age between 58 to 60 years, and central government is also looking for possibilities to increase retirement age to 65.

Some other countries have retirement age as high as 67 and governments globally more likely to increase the official retirement age.

Most of the factors that driving this trend of increasing retirement age is driven by increased life expectancy due to nutrition diet and medical advancements, and economic pressure due to insufficient savings and rising living costs including healthcare costs.

The Gap in India’s Pension System

For those who retired, monthly pension becomes their primary source of income, while others may depend on their children to meet their financial needs.

However, when we look at the broader picture, India stands out as one of the countries with low pension penetration, and the coverage remains insufficient.

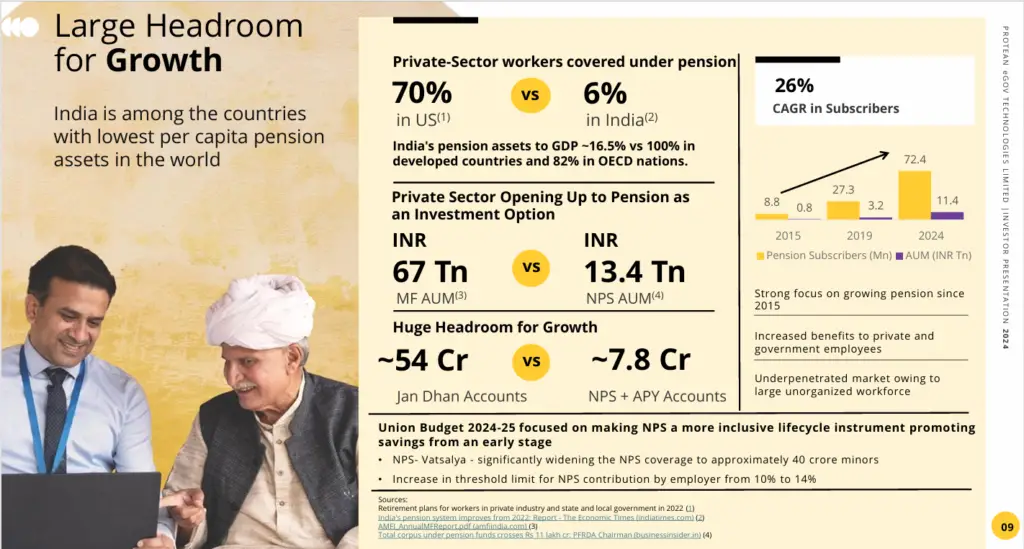

According to data from Protean-E Gov, approximately 70% of the U.S. population working in private sector is covered under a pension scheme, while in India, only around 6% of the population. It shows India is highly underpenetrated in pension services.

In other countries like Denmark, Netherlands, Australia, pension replaces 80% to 100% of the income after retirement, but in India its often below 50% of income.

Financial Dependency on Children: A Growing Concern

However, depending on children for financial security poses its own set of challenges. As lifestyle costs continue to rise, it’s becoming harder for families to manage their own expenses, especially with essentials like internet, mobiles and electronic gadgets now considered mandatory.

What was once considered a luxury for earlier generations is now part of daily life and become basic need for this generation.

With increasing lifestyle costs it’s difficult to run a family for themselves as internet and utilities are became mandatory these days, high school fees and high hospital charges.

With the increased risk of uncertainties in job market now and likelihood of these challenge growing in future, it will be even more difficult to navigate financial responsibilities.

Parents are not emergency fund, Children are not Retirement Fund. Live on your Own.

Small Business Owners Don't Retire

As the retirement age continues to rise for many formal jobs, the concept of retirement is becoming more complex. However, in the world of small business owners and local Kirana shopkeepers, the idea of retirement is almost non-existent.

In my surroundings I see many of the small business owners, local Kirana shopkeepers work even in their old age some by compulsion to run their household and some work just because they want to. For them “retirement” looks like a foreign term.

With these situations in place, considering the economic factors around retirement, now there is new trend which is gaining popularity especially in youth is Financial Independence and Retire Early (FIRE). Does FIRE really make sense? Or better question how to make FIRE work?

Lack of FIRE Examples

We have seen our older generation retire around 60 years of age, after completing all the responsibilities of dependents education and marriage. And I hope we all have a clear understanding on this path.

But coming to FIRE, we don’t really have much examples to relay on to take a break or complete exit from Jobs much early before even completing our responsibilities. If you read some FIRE stories around internet, it adds more stress than clear understanding.

From upcoming blogs, lets answer all the questions surrounding FIRE and focus more on what could go wrong and how to be prepared for everything.

Image credits

All the information shared is for educational purposes only. The blog Finance Made Easy(financemadeeasy.in) and the author is not responsible for your financial decisions.

To read more on retirement planning please click here

Sharing is caring!

Pingback: PART-3 FIRE: How Profitable Are Equity Investments?

Pingback: Part 4 – Important Questions on FIRE - Finance Made Easy

Pingback: Good News for Employees: EPFO’ Latest Changes - Finance Made Easy