Sharing is caring!

There is no surprise that you take debt once in your lifetime to fund your expenses. Many forms of loans available in the market include Home, Gold, Vehicle, Personal, and Credit Card EMIs. This is not wrong, but it is smart to use these loans to grab an opportunity in your life, but the problem starts when you feel like earning just to pay off these loans instead of yourself.

One bad loan you take can make you fall into a debt trap. To go forward this is the time to learn about what is a good loan and what is a bad loan?

How Loans Can Be Categorised As Good Loans And Bad Loans?

None of the loans is neither bad nor good by nature. But the usage of those loans whether it adds value to you or sucks the energy out of you makes them either a good loan or a bad loan.

For example, Education loans or Loans taken to expand your business are kind of good loans, and the rest of the loans that eat up most of your income bad loans. Even if you take a loan to go for a vacation can be a good loan as long as it helps you to refill your energy to go on with your life, but the same loan can be a bad loan when you end up spending your most of income to repay that loan.

Components Of A Loan | Principal and Interest

Any kind of loan is comprised of two components, Principle and Interest. The principle is the amount that you take in the form of a loan, and interest is the amount you are charged for the loan amount you take.

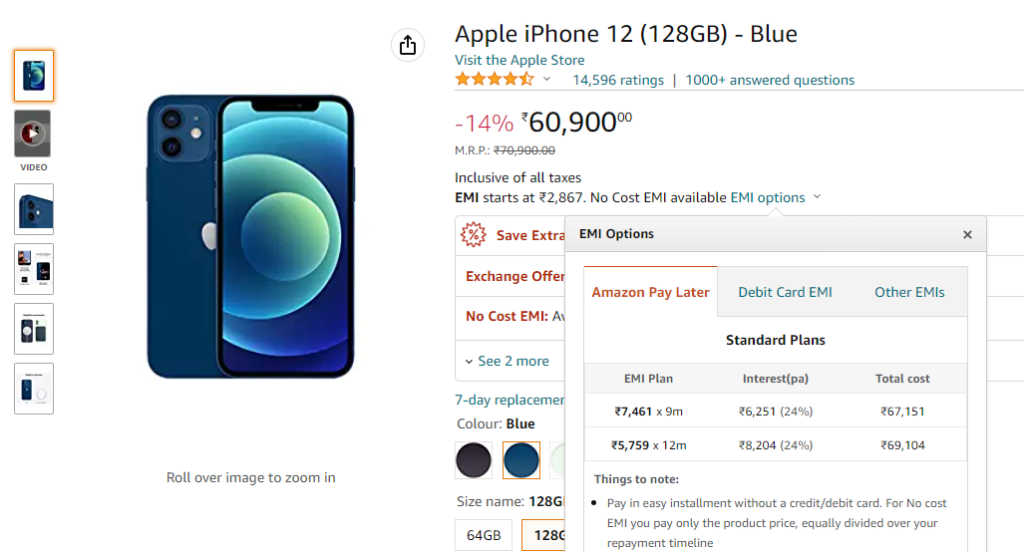

For example, if you take an EMI loan of 60,900 Rs to buy an iPhone that you pay 5759 Rs every month for 12 months. So you end up paying 69,104 Rs. Here the amount that you have paid has a Principal component of 60900 Rs (the Actual Price of the Product) and 8204 Rs is the interest Component. Your interest rate is 24%.

How Does This Loan Make You Fall Into Debt Trap?

If your monthly in-hand salary is about 25,000/- (this is the amount that most people earn from their first job or even less), having an EMI worth nearly 6,000/- every month for 12 months could be challenging. Living for 12 months with a leftover balance after EMI payment may be even more challenging as time pass. Here this single loan alone may not drag you into a debt trap especially when you follow the personal finance rules discussed here. But having multiple EMIs or missing the EMI payment will increase your interest component and land you in a Debt Trap.

What is Debt Trap?

It is a situation where your interest burden is more than your principal loan amount, at this moment the EMI’s you pay every month will be paid towards your interest component and your principal remains the same. As long as the principal amount isn’t paid your EMI payment always goes towards the interest component of your loan. This situation is called a debt trap.

Once you are into such a long debt trap closing your loans is difficult. But now you know the reason behind why you can’t clear the debt.

The main problem is because of the interest component in your loan. Now you will learn how to come out of debt.

Proven Methods To Come Out Of A Debt Trap

Consolidate Your Loans

You know your interest component is the main reason for your loan burden. Consolidating your loans is an approach where you take another loan with a lesser interest rate to pay your current loan which has a higher interest rate.

For example, in the above iPhone EMI case, you pay around 24% towards interest. In this case, what you can do is take a loan with lower interest something like a personal loan which usually has an interest rate of around 13%, and use the loan amount to pay your current loan.

In the image you can see that for the same price of 60,900 Rs, now you will be having an EMI amount of 5439 Rs instead of 5759 Rs and your total interest is now 4373 Rs instead of 8204 Rs. That’s a saving of a total of 3831 Rs.

If you have a good credit score you may even get a loan with a low-interest rate as well. Or if you have some asset like gold then you can take a gold loan with as low as an interest rate of 8%.

Snowball Method

This snowball method of debt repayment says to pay off the smallest loan of all the loans as quickly as possible. For example, if you have 3 loans as follows:

| Loan | Balance | EMI | Interest % | Tenure |

|---|---|---|---|---|

| Home Loan | 10 Lakhs | 8087 | 7.55% | 240 Months |

| Personal Loan | 15 Lakhs | 34500 | 13.5% | 60 Months |

| Vehicle Loan | 7 Lakhs | 15439 | 7% | 36 Months |

As per the example, you will pay 58026 Rs every month towards your loan EMIs. And it takes nearly 20 years to become debt free.

The snowball method of debt repayment suggests clearing the smallest loan (Vehicle Loan in this case) first. In this case, anyway, your Vehicle loan has 3 years tenure and it will be cleared first. Now after you clear your first loan, you will now have 15439 Rs. Snowball’s method of debt repayment suggests you use that amount to clear the next smallest debt which is your home loan in this case instead of using that amount for your other expenses.

So that now instead of 8087Rs you will pay 23526 Rs(15439+8087) towards your Home loan, so instead of paying for 20 years now, your home loan will be cleared as early as 7 Years . After the next smallest loan is cleared now move the funds to the next available smallest loan and repeat the process until all of your loans are cleared.

Avalanche Method

The Avalanche Method of debt repayment is an effective way of clearing your debts when you have high-interest loans on you. This Method says to pay the loans with a high-interest rate first. For the same example given above, the snowball method suggests focusing on clearing the Vehicle loan first, but the Avalanche method says to pay the high-interest loan(which is a Personal loan in this case) first. Later on, after clearing the Personal loan then you can focus on clearing the loan with the next highest interest rate which is a home loan in this case. Continue the process until you pay off all your debts.

You can use any of the above-said methods to clear your loans quickly. You will also find the calculators on this site in a couple of weeks to compare which method of debt repayment works for you.

Signs you may fall into a debt trap.

Here are some of the indicators that help you identify whether you fall into debt traps with your current lifestyle way before.

Early Signs Of Debt Trap

1. Debt To Asset Ratio

Debt to Asset Ratio = Total Debt/Total Assets.

If your assets include stocks, bonds, and FDs worth 50Lakhs, and your total debt worth 20 Lakhs. Then your Debt to Asset Ratio is 0.4.

Your Debt to Asset ratio between 0 to 0.5 is good. Anything above indicates risk.

2. EMI To Salary Ratio

EMI to Salary Ratio = Total EMI/ Total Salary.

If you have EMIs to be paid every month. If all of your EMIs consolidated together and divided by your income then the ratio is called as EMI to Salary ratio. For example, if your income is 50,000 Rs, and your EMI’s together is 30,000 Rs. Then your EMI to Salary ratio is 0.6.

Financial experts suggest that more than 0.3 of EMI to salary ratio is not recommended.

3. Fixed Expenses >70%

Every month you spend on your needs, wants, and savings. Your needs are your fixed expenses. If your fixed expenses are more than 70% of your income then there are high chances that any unplanned expense can force you to take a loan to fund that expense.

4. Having Too Many Loans

Having too many loans means you have highly leveraged credit which is always risky. Even any small unplanned expense may lead to default of any of the loan which attracts penalties and lead to the debt trap.

Conclusion

The best piece of financial advice I have ever got is AVOID DEBT. But at times, we may still end up taking debt. These debts aren’t bad until you have too many loans, or fixed income >70 percent, or EMI to salary ratio >0.3, and a Debt to Asset ratio>0.5. At this time you need to be cautious and act instantly. You can reduce the burden of interest on you by taking a loan with lower interest to pay off your high-interest loan. Or if you have to pay many small debts to pay snowball method of payment to clear a loan becomes handy. If you identify your issue with loans is due to the high-interest loans, then try to clean them using Avalanche Method.

All the information shared is for educational purposes only. The blog Finance Made Easy(financemadeeasy.in) and the author is not responsible for your financial decisions.

Sharing is caring!

Comments