Sharing is caring!

The government has introduced Retirement Funds like Employee Provident Fund(EPF), Public Provident Fund(PPF), National Pension Scheme(NPS), etc to provide social security to the people. And for the emergency needs like children’s higher education or marriage, these schemes also allow you to withdraw partial amounts.

You can also take a loan on your PPF balance popularly known as a 1% interest loan. In a Needful situation, these withdrawals of your own money make sense instead of taking loans, but this is the costliest mistake one can make for their retirement funds.

Now let us discuss a few of the costliest mistakes one can make knowingly or unknowingly to their retirement fund.

Table of Contents

Toggle1. Periodic withdrawals of retirement fund

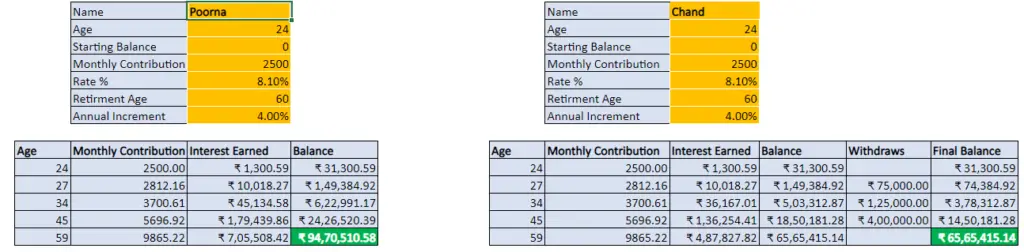

By withdrawing your savings or investments in your retirement fund(long-term fund) you are missing out on the magic of compounding. To see this in action let us compare two people Poorna and Chand. Poorna believes in compounding and doesn’t withdraw his/her retirement fund. Whereas Chand withdraws long-term retirement savings for various needs in his life.

Poorna and Chand both are contributing to the retirement product EPF from age 24 till retirement. For calculator purposes, assuming their salary increment is 4% every year so does the EPF contribution increase 4% every year. And monthly contribution starts from 2500 and increases by 4% every year.

Poorna doesn’t withdraw his retirement fund, by contributing to his EPF every month till he retires finally he has built nearly 94 Lakhs of retirement corpus.

Chand withdraws money from his EPF account 3 times, 75,000 Rs at 27, 1,25,000 Rs at 34, and 4,00,000 Rs at 45 for personal expenses.

Chand withdraws a total of 6 Lakhs from his retirement fund. Finally, he build the retirement corpus of 65 Lakhs. Which is 29 Lakhs less than Poorna.

Just by withdrawing only 6 Lakhs, Chand has nearly lost the opportunity to make 29 Lakhs more retirement corpus.

2. Starting Late

The main advantage of all the long-term investment products is that they compound over time. Longer the time horizon higher the compounding.

At an early age, you may be wanted to spend on vacations, the latest trending gadgets, or weekend parties. There is no problem with that but in the future when you realize to save for yourself then you need to spend more than what you can afford.

For example, in the previous post in the retirement planning series, Chapter 3. We have compared Poorna and Chand who started investing for their retirement in the same product for the same return expectation but Chand started investing 10 years late than Poorna.

The result is, that Poorna made 3.9 Crs by investing 5,000 Per month. At the same time, Chand starting 10 years late, can make 2.45 Crs even after investing 100% more than Poorna every month.

Starting investing late not only results in lower returns but also to achieve your required goal amount you need to invest more than twice or even thrice as we have seen in the case of Poorna and Chand in Chapter 3.

3. Ignoring the importance of medical insurance

Everyone suggests to start investing and also believes in long-term investing. And most forget to address the importance of medical insurance role in saving your hard-earned money at difficult times.

As an example, what could be the required sum of money for any kind of surgery or treatment when you are admitted to a hospital? Even a daycare treatment cost up to 1 lakh(* subjective).

Medical inflation is roughly 15% a year. Which is very much higher than the average returns from the Indian stock market of 12% (Index returns).

This means, that medical inflation is higher than the average returns of Indian top 50 companies’ growth.

Let us assume you may need some 10 Lakhs for a treatment. Do you know how long will it take for you to save or earn that amount?

If you are earning 40 thousand a month and even after investing 15 thousand a month(37% of your income) you need 5 years to save that amount. But you lose all your hard-earned money only because you don’t have any health insurance.

The conclusion is, that health insurance not only finances your medical expenses but saves your years of hard-earned money.

4. Investing in only one asset class

You may know that equity(stock markets) gives potentially high returns than any other asset class like debt funds, fixed deposits, and LIC policies.

And also since stock markets have risks involved you diversify by investing in different sectors and different stocks.

But still, you are investing in only one asset class i.e., stock markets.

You not only need to diversify your stock portfolio but also diversify across different asset classes. We have never seen a prolonged underperformance in the Indian stock market like in japan.

We will discuss the power of hedges and diversification in a future post.

5. Underestimate required Corpus

With the rising inflation and major lifestyle upgrades becoming a necessity in life there is always an increase in the cost of living.

Inflation is a silent villain for your finance. It always eats the value of your money.

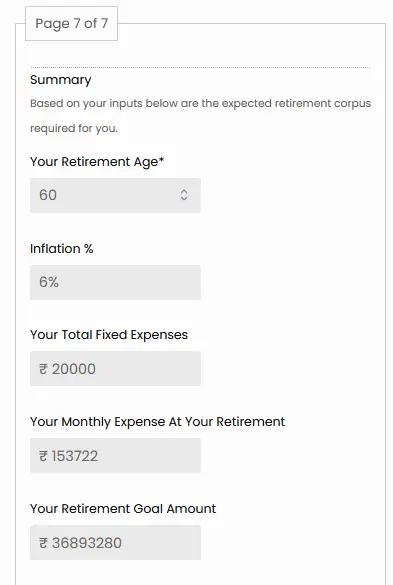

For example, if your expenses per month are 20,000 Rs, what is your estimate of how much money is required for you after your retirement?

You need 3 Cr 68 Lakhs of retirement corpus and you need to spend nearly 1 Lakh 53 thousand for your monthly expenses to maintain the same standard of life after 36 years from now.

You can calculate your required retirement corpus and monthly expenses after you retire from here.

6. Pay attention to Commissions.

If you are investing in regular mutual funds as directed by the bank manager or any reputed mutual fund distributor you may pay up to 1% commission to that distributor. 1% seems so minimal but it is a lot of commission you are paying.

For example, If you are investing in a mutual fund with a return expectation of 10% p.a. if you invest in the direct mutual fund then you get 10%, and if you invest through the distributor you get 9% p.a and 1% is distributor commission.

Your returns by investing 5,000 per month for 30 years in a direct mutual fund is 1.13 Crores.

At the same time by investing the same through the distributor(with commissions being paid) you have 92 Lakhs.

You just paid 15 Lakhs as commission.

Pay attention to the commissions, they do eat a lot of your profits.

7. You think you are already a master in finance

Finance as a subject is never thought of in schools. People never talk about their finance with anyone. This creates a lot of financial concepts uncovered to most people.

“No one is crazy with money” – morgan housel

With limited exposure to the game of finance, everyone can build their understanding of money. And mostly follow the methods of their family members.

If your parents used to save most of their money in Bank FD and Gold you mostly follow the same, If your parents had invested in Insurance Policies you may do the same. And if your parents or family members do the real estate you may also be interested to buy real estate properties.

Family and society decide your financial decisions somehow.

In the olden days’ inflation used to be low, and bank FDs earn more than the rate of inflation. So the Bank FDs have been better investments for them. And now most of the bank’s FDs never beat inflation and hence you are losing by saving your money in Bank FDs.

The only solution is to update your financial knowledge to avoid most of the financial mistakes that society or your family make you.

Upgrade your financial knowledge as per the changing dynamics.

All the information shared is for educational purposes only. The blog Finance Made Easy(financemadeeasy.in) and the author is not responsible for your financial decisions.

Sharing is caring!